Indicators on Frost Pllc You Should Know

Indicators on Frost Pllc You Should Know

Blog Article

How Frost Pllc can Save You Time, Stress, and Money.

Table of ContentsThe Definitive Guide to Frost PllcFrost Pllc Things To Know Before You BuyIndicators on Frost Pllc You Should KnowFrost Pllc Things To Know Before You BuyThe Main Principles Of Frost Pllc

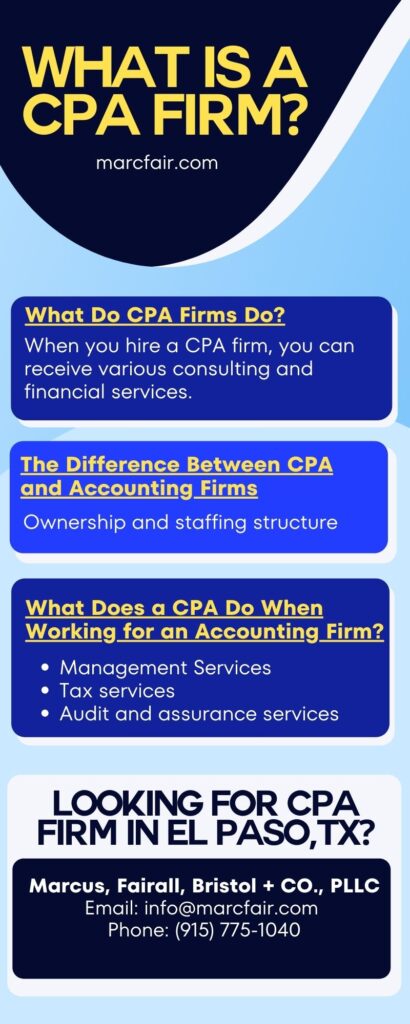

Certified public accountants are among the most trusted occupations, and forever reason. Not just do CPAs bring an unmatched level of expertise, experience and education to the procedure of tax obligation planning and managing your money, they are especially trained to be independent and unbiased in their job. A certified public accountant will assist you secure your interests, pay attention to and address your problems and, equally important, give you satisfaction.In these defining moments, a CPA can offer more than a general accounting professional. They're your relied on advisor, guaranteeing your organization stays financially healthy and lawfully secured. Hiring a regional CPA company can favorably impact your business's economic health and success. Here are 5 key benefits. A local CPA firm can help lower your business's tax problem while ensuring conformity with all applicable tax obligation laws.

This development shows our commitment to making a positive impact in the lives of our clients. Our dedication to excellence has been recognized with several distinctions, including being named one of the 3 Best Audit Companies in Salt Lake City, UT, and Finest in Northern Utah 2024. When you function with CMP, you enter into our family members.

More About Frost Pllc

Jenifer Ogzewalla I've functioned with CMP for numerous years now, and I've actually valued their competence and effectiveness. When bookkeeping, they work around my timetable, and do all they can to keep continuity of employees on our audit. This conserves me energy and time, which is very useful to me. Charlotte Cantwell, Utah Event Opera & Music Theater For a lot more motivating success tales and comments from company owner, click on this link and see how we have actually made a difference for companies like yours.

Right here are some vital concerns to assist your choice: Examine if the certified public accountant holds an active license. This assures that they have actually passed the needed examinations and fulfill high ethical and professional requirements, and it reveals that they have the certifications to manage your financial issues sensibly. Confirm if the certified public accountant offers services that align with your business requirements.

Small services have distinct financial needs, and a Certified public accountant with appropriate experience can supply even more customized suggestions. Ask regarding their experience in your market or with services of click here for more info your size to guarantee they comprehend your specific difficulties.

Hiring a local CPA firm is more than simply contracting out monetary tasksit's a smart financial investment in your organization's future. browse around this web-site Certified public accountants are accredited, accounting experts. Certified public accountants might function for themselves or as component of a firm, depending on the setting.

Not known Details About Frost Pllc

Tackling this responsibility can be an overwhelming job, and doing something incorrect can cost you both monetarily and reputationally (Frost PLLC). Full-service CPA firms recognize with filing needs to ensure your business weblink abide by government and state legislations, in addition to those of banks, financiers, and others. You may need to report extra revenue, which might require you to submit an income tax return for the first time

team you can trust. Call us for additional information about our solutions. Do you understand the bookkeeping cycle and the steps associated with making certain correct financial oversight of your organization's financial wellness? What is your business 's legal structure? Sole proprietorships, C-corps, S companies and partnerships are taxed in different ways. The more complicated your profits sources, venues(interstate or worldwide versus neighborhood )and sector, the a lot more you'll need a CPA. CPAs have extra education and learning and undergo a rigorous accreditation process, so they set you back even more than a tax obligation preparer or bookkeeper. Typically, small companies pay in between$1,000 and $1,500 to hire a CERTIFIED PUBLIC ACCOUNTANT. When margins are limited, this cost might beunreachable. The months prior to tax obligation day, April 15, are the busiest season for CPAs, followed by the months before completion of the year. You may have to wait to obtain your questions addressed, and your income tax return might take longer to finish. There is a restricted number of Certified public accountants to walk around, so you may have a hard time finding one particularly if you have actually waited up until the eleventh hour.

CPAs are the" large weapons "of the accounting industry and normally don't handle everyday bookkeeping jobs. Often, these other kinds of accountants have specializeds throughout locations where having a CPA certificate isn't required, such as administration bookkeeping, not-for-profit audit, expense bookkeeping, federal government accounting, or audit. As an outcome, making use of a bookkeeping solutions firm is often a much better worth than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to company your ongoing financial continuous economic.

CPAs also have competence in developing and perfecting organizational policies and treatments and evaluation of the useful requirements of staffing models. A well-connected Certified public accountant can take advantage of their network to help the company in various tactical and consulting roles, properly attaching the organization to the optimal candidate to accomplish their demands. Following time you're looking to fill a board seat, take into consideration reaching out to a Certified public accountant that can bring worth to your company in all the methods noted above.

Report this page